David Foster’s Wallace’s post-morten novel The Pale King is about, to some extent, IRS agents finding zen in the tedium and complexity of the Internal Revenue Code. According to one article about Wallace and his “latest” work, he was fascinated by our tax system, took accounting classes after he was already a literary superstar, and corresponded with real-life IRS employees about the minutiae of tax collection. One of them sent him a copy of IRC § 509(a), a brief sub-section that is apparently renown as one of the most difficult passages of the tax code to understand and which, in an apparent inspiration for one of the “plot” points in The Pale King, can bring on Nirvana if you meditate on it as if it were a koan.

Even routine parts of the tax code can be difficult to tweeze apart - the home mortgage deduction, one of the most commonly-claimed deductions, is an exception to an exception to a main rule: 1) interest is deductible; see IRC §163(a); except for “personal interest”; see IRC § 163(h); except for personal interest that is “any qualified residence interest”; see IRC § 163(h)(2)(D).

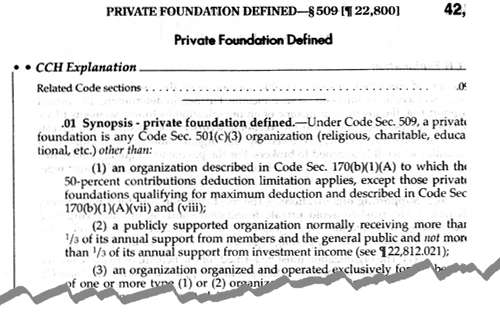

As complicated as that is, IRC § 509(a) leaves that double-exception and all its attending cross-references and definitions behind in a cloud of dust. Its about the general rule for the definition of a private foundation and starts out like this:

Then, in the rest of the 430 words of § 509(a) it has eleven references to other sections of the IRC, 16 internal references to § 509 itself, sixteen instances of the word “organization” and over thirty instances of terms related to income, fees, receipts or other financial terms.

How can someone make sense of all this? Luckily, we have several good tax resources that help to explain complicated sections of the tax code like § 509. One is the CCH Standard Federal Tax Reporter, a multi-volume looseleaf set available on reserve at the circulation desk at KF 6285 .C67. As a looseleaf, it is updated weekly with new pages so it is always very up to date.

Here is the beginning of the four-page “CCH Explanation” for IRC § 509:

An explanation like this helps to unwrap the tangled web of dense text in a section like 509 and attempts to explain it in something more resembling the English language. Even this explanation is still pretty dense, but one other source may be more helpful and straightforward.

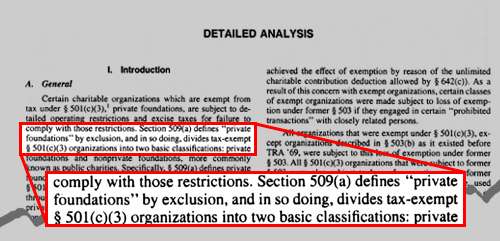

The BNA Tax Management Portfolios are a series of looseleaf pamphlets and is located in the stacks at KF 6289.A1 T35. Like the CCH set, it is always kept up to date with new material. An index volume lets you find the pamphlet that discusses specific sections of the tax code: here is the beginning of the sixty-nine page “Detailed Analysis” from the main pamphlet that covers IRC §509:

This is an even more “plain language” explanation of this provision of the tax code, but it would still take a lot of reading to understand what, ultimately, the definition of a private foundation is. Secondary resources like these can be very helpful for many reasons: court decisions can be confusing because its not the judge’s job to break down the legal concepts involved in a case into understandable chunks of information, and, as we’ve seen here, Congress often seems to write statutes, particularly the tax code, in a way that seems deliberately confusing. Oh, and neither the Standard Federal Tax Reporter nor the Tax Management Portfolios are available to us on Westlaw or Lexis. Westlaw does have the Portfolios on-line, but not as part of their academic accounts.

For any assistance you may need in locating or using resources like these, find one of the reference librarians, either at the reference desk or in our offices. We’ll be glad to help!

No comments:

Post a Comment